See: How Long Can You Stay on Your Parent’s Health Insurance?

Dec 18, 2023 By Triston Martin

Introduction

Your decision to sell the investment is well-timed. When it comes down to selling stock is a straightforward process that need not frighten the inexperienced investor whether the stock performs well or poorly. Selling stock in today's app-driven market is as simple as listening to music on a streaming service. Finding and working with a reliable financial advisor can be just as stress-free for others who prefer more personal interactions. While various methods can determine when to sell a stock, one of the most effective is establishing a target price and then selling the stock once it reaches that point.

Reasons To Sell A Stock

Five situations are listed below in which it might be prudent to sell stock:

Your Investment Thesis Has Changed

Your original justifications for purchasing a stock may no longer hold water. Consider the original motivations for your stock purchases and evaluate whether or not they now hold water. Each stock purchase should be motivated by more than just the desire to increase your wealth; this motivation takes the form of an investment thesis.

The Company Is Being Acquired

The announcement of an agreement to be purchased by another company is yet another event that could be seen as a positive catalyst for sale. The stock price of the acquired company usually rises after an acquisition announcement to a level close to the agreed-upon purchase price. The acquisition announcement may signal a good time to lock in profits, as additional appreciation may be limited.

You Need The Money Or Will Soon.

Never put money into the stock market that you will need to use within the next few years. However, selling is understandable if financial constraints force you to do so. To pay for the down payment on a property, perhaps you might liquidate some stocks. You may also want to sell your stocks and put the money you'd otherwise use to send your kids to college into safer investments like CDs.

It Would Help If You Rebalance Your Portfolio.

There are many ways in which your financial portfolio can become imbalanced. That's why most investors need to rebalance their portfolios from time to time, which may require selling some stocks.

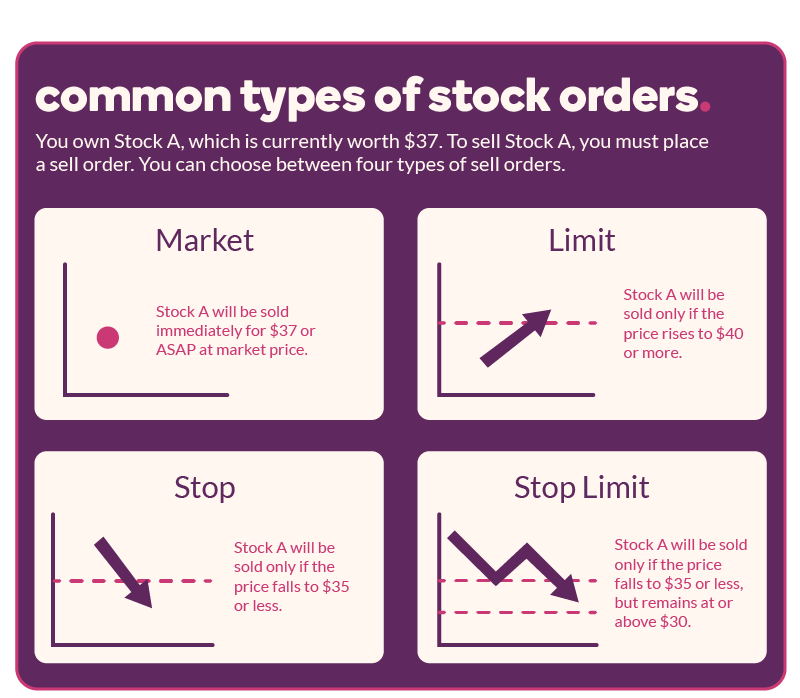

Types of Sell Orders

A sell order is the most fundamental method of selling stock. After deciding to sell, the next step is to select the appropriate sell order type. To name a few of the most common forms of sales-related orders:

Market Orders

At the present market price, these orders are sold very instantly. The advantage is that requests are fulfilled rapidly. The catch is that you'll have to settle for whatever the market's lowest asking price is at the time.

Limit Orders

With these orders in place, the stock won't trade unless a buyer offers at least the minimum acceptable price (or goes higher). A vendor can rest easier knowing just how much money they'll make. You risk your order getting lost in a sea of others waiting to be processed.

Stop Orders

In this scenario, the seller sets a selling price and only executes the sale if the stock price dips below that price. An advantage of using a stop price is that it acts as insurance against a stock's value falling too far; once the stock reaches the stop price, your position will be sold automatically as a market order. However, stop orders typically anticipate the worst-case situation, meaning that if the order is triggered, you will receive the next available price even if the stock is highly volatile. You can expect your limit order to be filled if and only if the market price reaches your stop price; otherwise, you risk your order being canceled.

Working With a Financial Advisor

If you purchased stock from a financial advisor in person or over the phone, that expert could also help you sell your shares. Most sell orders sent to financial advisors are fulfilled within a day. Be aware that you will need to talk either verbally or in writing to communicate with your broker in this situation. Investopedia says financial institutions do not accept email or voicemail trading requests since they are easily missed.

Conclusion

There has never been a better time to get started in the stock market because there are so many avenues via which one can purchase and dispose of shares. You can always decide to wait if you're unsure whether or not to sell a stock or if you're not sure if now is a good time to sell. Holding on to a stock for the long haul can be a lucrative financial strategy, and you should never feel pressured to sell. Billionaires Warren Buffett and Charles Brandes advocate this strategy, "buy and hold." When the time comes to sell, you'll be prepared to place your order with minimal effort.