What Is The Annual Percentage Yield, And Why Do You Need To Know It?

Feb 02, 2024 By Triston Martin

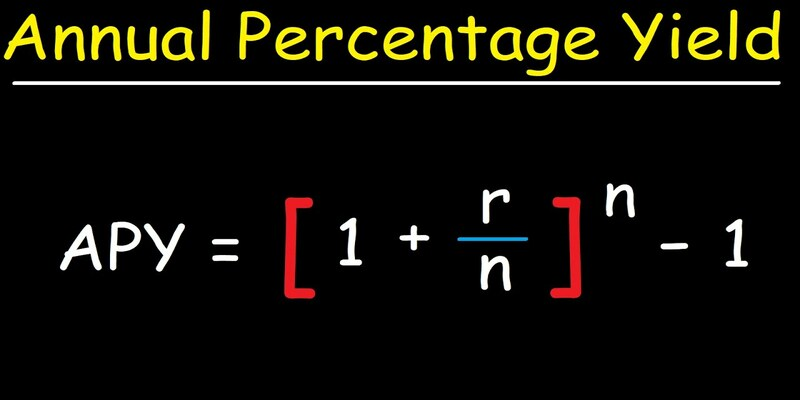

The potential interest you receive on a savings and CD account over a year is expressed as its Annual Percentage Yield (APY). How To calculate the annual percentage yield or APY, compound interest is added to your cost of borrowing. Your savings account's annual percentage yield (APY) is 0.03%, as you've just discovered. Your interest rate seems connected to the annual percentage yield (APY), but the two differ. The annual percentage yield (APY) is the actual rate of return on an interest-bearing account, such as savings, alternative investments, certificate of deposit (CD), etc., over more than a full calendar year. Because your money increases over a year because interest is added, the annual percentage yield (APY) is higher than the return advertised by the financial institution. Check out this article for further information on annual percentage yield.

How Do You Define Apy Or Annual Percentage Yield?

The actual rate of return you get from an interest-bearing account each year is calculated using the annual percentage yield (APY) method. The term "compounding" refers to increasing your interest earnings to your initial investment. Your interest for tomorrow will be $5 on a balance of $500,000, assuming you earn $5 today. The rate of interest compounding may be set to occur once per day, once per month, once per year, or at any other interval. Compounding may occur daily or monthly for savings and alternative investment accounts.

The interest accrued on a CD is usually paid out after the period. For example, the interest payment is made on a certificate of deposit (CD) one year after it was opened. Accounts that accrue interest may have either a fixed or fluctuating interest rate. For example, when the Federal Reserve raises or lowers interest rates, savers may see a spike or decline in their interest rate.

The Workings Of Annual Percentage Yield

Earn interest on your savings, alternative investments, or CD deposits. The annual percentage yield (APY) indicates however much interest you may expect to receive on the account each year. The annual percentage rate and the compounding regularity show the total interest that would accrue, including interest on the principal (the initial deposit) and interest upon that interest on the profits.

Why The Annual Percentage Yield Is Not Like Other Yields

A deposit account's annual percentage yield (APY) is a more precise indicator of how much interest you will receive than the standard interest rate (no compounding). Interest compounds when it is added to the initial investment (the main) and the cumulative earnings (the interest).

Example Of A Single Annual Payment

Imagine you have $1,000 you want to invest at a straightforward 5% interest rate each year. There would be an extra $50 throughout your account after the calendar year if your bank only calculated and paid interest once every year. You would conclude the year with $1,050.

Example Of Monthly Compounding

Let's pretend for a moment that the bank calculates but instead pays interest on something like a monthly basis. Every month, you'd get a little bit more. If you did that, you'd have $1,051.16 at the beginning of the year, which is greater than the 5% annual interest rate. While the difference may not seem like much at first glance, it may add up to a sizable sum over many years, sometimes with more significant investments. Look at the table below to see how the monthly profits increase over time.

Apr Vs. Apy

A financial institution's interest rate charged on credit cards and mortgages is expressed as an annual percentage, commonly known as the annual percentage rate (APR). Similar to the yearly percentage yield, it doesn't factor in compounding. The distinction between the annual percentage rate and the annual percentage yield is obvious with credit card borrowing. Carrying a balance on a credit card might result in a far higher effective annual percentage rate (APY) than the APR advertised by the credit card company. You'll have to fork up even more interest next month. 4 This is similar to the compound interest you get from a savings account. Even though the difference is little, it is still there. This disparity widens as your loan size and term length increase.

Conclusion

An investment's real rate annual return, adjusted for compounding interest, is expressed as the annual percentage yield (APY). Interest payment, as opposed to simple interest, is computed periodically and added towards the principal balance at that time. The interest accrued on a growing account balance is proportional to the size of the amount at any given time. Loans employ an annual percentage rate (APR). It's important to note that the annual percentage yield (APY) on your bank account, savings account, or CD may be variable or fixed depending on your chosen product. However, the interest rate on a certificate of deposit (CD) is typically locked in for the life of the CD's term. Check to see whether your CD allows you to change the interest rate once throughout the time if rates increase since this is a helpful feature if you anticipate that rates will climb.